Tax Reform Bill: VAT As a Consumption Tax

By Arabinrin Aderonke

People have been talking about the proposed bill, discussing its potential, the concerns, and the necessary changes it could bring to Nigeria’s tax system. The Tax Reform Bill, with its proposed shift in the VAT derivation formula, is no small matter. The reform has the power to reshape Nigeria’s tax system and, by extension, its economy. It promises to address long-standing issues within Nigeria’s tax structure, with a focus on making the VAT distribution process more equitable for all regions.

During a recent session at the House of Representatives on the proposed tax reform bills, Dr. Zacch Adedeji, Executive Chairman, Federal Inland Revenue Service (FIRS), presented an insightful case for restructuring the Value Added Tax (VAT) derivation formula. His explanation highlighted both the advantages of the reform. The Tax Boss explained that VAT is fundamentally a consumption tax, and as such, it should reflect where goods and services are consumed rather than where transactions are recorded.

Under the current VAT framework, revenue is allocated based on the location of corporate headquarters or business operations rather than where actual consumption takes place. This approach has resulted in states like Lagos, Rivers, and the Federal Capital Territory (FCT) receiving a disproportionate share of VAT revenue. For instance, Lagos currently accounts for 42%, Rivers 16%, and the FCT 9% of the nation’s VAT collections. Meanwhile, states such as Borno and Bauchi receive less than half a percent each.

One of the primary benefits of the new VAT derivation formula is the potential for a more equitable distribution of tax revenue. The current system heavily favours states with high production capacities, such as Lagos and Rivers, leaving other regions with far less. This has created an imbalance where wealthier states continue to prosper while others struggle with fewer resources. The shift to a consumption-based formula means that revenue will be distributed based on where goods and services are consumed, not where they are produced. This change could be especially beneficial for states with large populations but lower production capacities, ensuring that all Nigerians, regardless of where they live, have access to improved public services and infrastructure.

By distributing VAT revenue more evenly, the reform will help bridge the development gap between regions. States that have been marginalized due to their low consumption rates would see an increase in their share of the national revenue. This would allow them to invest in sectors such as education, healthcare, and infrastructure, which are essential for improving the quality of life for their residents. The reform also has the potential to promote national unity. By ensuring that all states receive a fair share of VAT revenue, the government could reduce feelings of regional inequality.

A concern with the reform is that states like Lagos and Rivers, which currently bring in the most VAT revenue, may see a decrease in their share under the new formula. This could strain their budgets and lead to delays or reductions in public services and key projects. However, while these states may face some short-term challenges, they have the means to adjust over time. In the long run, the goal of the reform is to share the country’s wealth more fairly, which will benefit all states, including those that generate the most revenue.

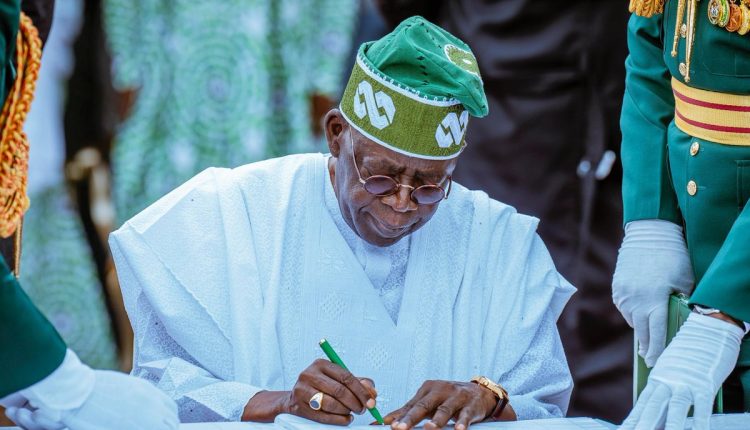

Under President Bola Ahmed Tinubu’s Renewed Hope Agenda, Dr. Zacch Adedeji is not just tackling the current problems between regions, but also offering solutions that will help the country grow steadily and stay united in the long run. His goal is to create a Nigeria where all regions have the chance to succeed equally, which is necessary for a better future for everyone in the country.

_Arabinrin Aderonke Atoyebi is the technical assistant on broadcast media to the Executive Chairman of the Federal Inland Revenue_